What is prompting providers to change manufacturing from China?

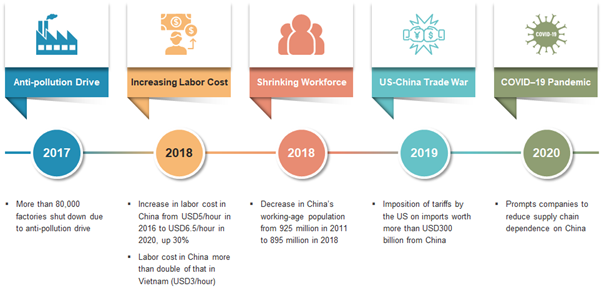

In excess of the earlier two many years, China has served as the manufacturing hub for providers in several industries globally. Even so, trade war with the US, expanding price of labor, lack of manpower and the latest COVID19 pandemic may make it hard for China to retain its posture as the epicenter of producing.

Critical Drivers for the Change

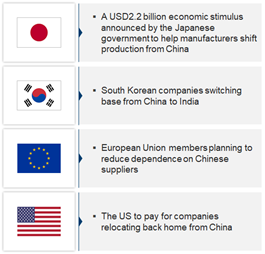

Since early 2019, producing providers around the globe have been searching to reduce their source chain dependence on China. The outbreak of the pandemic has intensified the quest for diversification of manufacturing. Nations throughout the entire world are supporting their providers in the bid to transfer out from China.

Also Read: ETAuto First: Who Will Change China- India or Vietnam?

Also Read: Impression: Auto gross sales publish COVID-19 – The road to recovery

Governing administration Aid

Will functions be shifted totally or in portion?

Although some providers will change foundation from China, they may not essentially transfer out all functions, for barely any other country features the identical organization-helpful atmosphere as China. Most providers will, for that reason, change only a portion of the organization to nations around the world these types of as Vietnam, India, Thailand and Malaysia.

Companies may fairly go for the China as well as one’ tactic. With this, they can diversify source chain threats and still faucet alternatives in the country.

Also Read: Impression: 7 techniques for Indian automobile sector to be self-reliant

Positive aspects of Undertaking Business enterprise in China

How will China respond to the mass exodus of providers? Are variations in sourcing dynamics most likely?

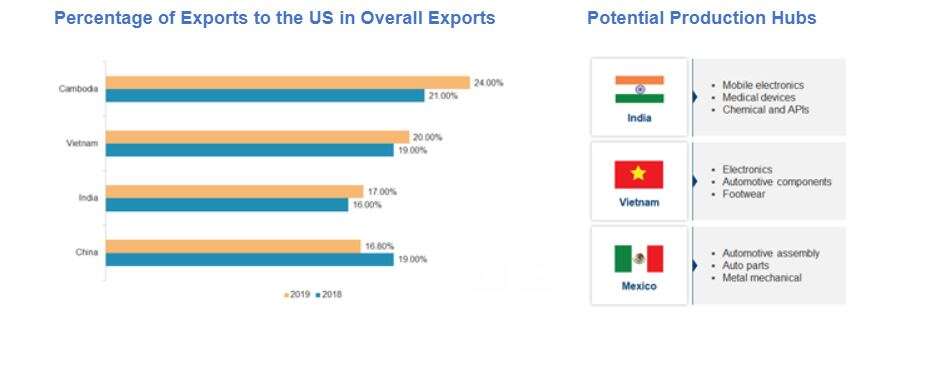

Creation shifting to rising markets:Nations these types of as Thailand, Malaysia, Bangladesh, Vietnam, Mexico, India and the Philippines may emerge as the favored destinations for producing. In 2019, a lot more than fifty multinational providers resolved to relocate their producing functions (partially or completely) to Southeast Asia and Mexico from China.

In the past fifteen months, the share of developing nations around the world in imports to made economies has amplified, although that of China has declined. The trend will only strengthen as the migration of manufacturing proceeds.

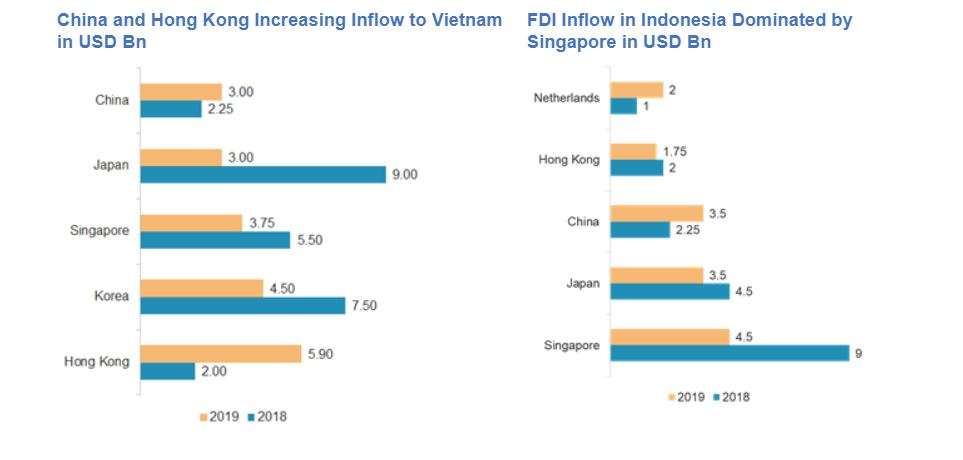

Raising investment decision by Chinese providers in Asian nations around the world: A lot of providers in Southeast Asian nations around the world (these types of as Vietnam and Indonesia) are owned and financed by Chinese providers, a trend that is anticipated to boost in upcoming. The FDI information does not give the complete photograph as Chinese providers channel their investments by means of Singapore and Hong Kong in some instances.

Leveraging no cost ability in China: The excessive ability in China, as an consequence of migration of manufacturing, could prompt European and Asian nations around the world to investigate the likelihood of sourcing goods at a lower price. Even so, this will only be achievable if these nations around the world do not impose anti-dumping duties or import tariffs.

Heading in advance:

* Excessive ability could result in a selling price war.

* China may create its domestic marketplace.

* China may dump items at a lower price in Africa, Latin The usa, the Center East, and so forth.

Also Read: ETAuto Originals: An anatomy of the Indian automobile sector

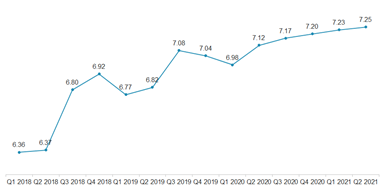

USD/CNY Trade Level

Devaluation of Yuan: China could devalue its forex, which would render exports cheaper and, for that reason, a lot more aggressive. It devalued the yuan in 2015 in reaction to the slipping advancement level and again in 2019 to offset the affect of the import tariffs imposed by the US.

New strategies are becoming devised to offer with the crisis and its financial implications~

Even so, devaluation will boost the price of imports to China, and consequence in larger inflation and cash outflows.

Although providers are searching to change manufacturing from China, only a portion of the functions will be moved out. Presently, no other country matches China in phrases of infrastructure, source chain, and labor legal guidelines, components that make it a well known industrial hub.

The China as well as one tactic will be the new norm, going ahead, and rising nations these types of as Vietnam, India and Mexico stand to benefit the most from this.

Switching foundation will be decided by proximity to the sourcing vacation spot and the countrys attractiveness for the certain sector (for instance, electronics in Vietnam and chemicals in India).

The world-wide pandemic is progressively switching the entire world. New strategies are becoming devised to offer with the crisis and its financial implications. Diversifying manufacturing will give a hedge from any other calamity of world-wide proportions, add to producing a sturdy source chain and lower the financial affect of any these types of disaster.

(The writer is the Head of Procurement Intelligence, Aranca)

(DISCLAIMER: The views expressed are solely of the writer and ETAuto.com does not essentially subscribe to it. ETAuto.com shall not be dependable for any inju

ry caused to any individual/organisation right or indirectly.)