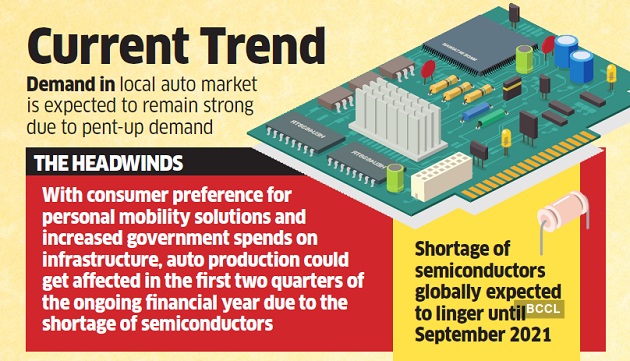

The present world-wide semiconductor lack, which has strike automotive providers throughout continents, could last through the 1st half of FY22 and disrupt output for an sector that is struggling to promote autos amid the episodic curbs on mobility.

The present world-wide semiconductor lack, which has strike automotive providers throughout continents, could last through the 1st half of FY22 and disrupt output for an sector that is struggling to promote autos amid the episodic curbs on mobility.

Whilst demand from customers in the community marketplace is anticipated to keep on being potent thanks to pent-up demand from customers, shopper preference for personal mobility remedies and elevated government spends on infrastructure, creation could get afflicted in the 1st two quarters of the ongoing financial calendar year thanks to the lack of semiconductors, reported Vikram Mohan, Taking care of Director at Pricol India.

There is a huge lack of semiconductors globally thanks to boost in demand from customers for laptops, smartphones article the outbreak of the pandemic. This lack is anticipated to linger on right until September 2021, reported Mohan.

Gross sales could get afflicted by 15% in this interval thanks to disruption in the supply chain.

Pricol is a Coimbatore-centered provider of diversified car components like instrument clusters, sensors and switches, pumps and mechanical products and solutions, telematics remedies and wiping programs.

In spite of troubles arising from lack of semiconductors and the contemporary surge in Covid-19 cases throughout the state, Pricol expects demand from customers to keep potent and to improve enterprise by thirty% in the ongoing fiscal calendar year.

We hived off our operations in Brazil, Czech Republic and Mexico, proper-sized our operations, invested heavily in products and approach engineering the previous pair of several years. All these actions served us in improving our margins. We ended up able to outgrow the marketplace in Q2, Q3 and This fall of the last financial calendar year, reported Mohan.

Pricol experienced a subsidiary in Spain that was the keeping arm for action-down subsidiaries in Brazil (obtained in FY15), Mexico and Czech Republic (obtained in FY18). The providers ended up loss-earning with put together losses throughout three action-down subsidiaries at Rs 105 crore in FY19 and Rs 89 crore in FY20, respectively.

The three providers together with Spanish keeping business have now been hived off with all liabilities tackled and expenditure of Rs 400 crore in these providers composed off. Consequently, consolidated debt on publications has lowered sharply from Rs 431 crore in FY20 to Rs 283 crore as of February 2021. Pricol reported revenues of Rs 1203.29 crore in FY20. Earnings for the last financial calendar year are scheduled to be announced on May 26.

The business reported it is at the shut of an expenditure cycle and would not need significant sources for cash expenditure around the subsequent pair of several years. Mohan informed the business would have to contemplate setting up a new production facility in the western part of the state if the demand from customers momentum stays potent, but would not call for major sources for the identical. As a substitute, it would continue to commit up to 4.five% of its net gross sales in investigation and advancement to be foreseeable future-ready.

Get the job done is presently on to deliver in components for electrical autos in the subsequent two several years. Pricol has a net debt of Rs 235 crore on its publications, which it aims to neutralise by that time to get leverage for the subsequent phase of growth in the business. Mohan reported, We will have our subsequent set of products and solutions ready by 2023. We are not searching at any acquisitions but aim to improve organically.

With no additional cash assist in the direction of erstwhile loss earning entities & large capex cycle guiding it (invested Rs three hundred crore in FY18-20), we count on B/S deleveraging physical exercise to collect pace, ICICI Immediate Exploration reported in a notice dated April 1, 2021.